.png)

US Stock Market Analysis and Forecasting

Analyzing and forecasting US stock market trends with a focus on tech stocks, market volatility, and price prediction

.png)

Analyzing and forecasting US stock market trends with a focus on tech stocks, market volatility, and price prediction

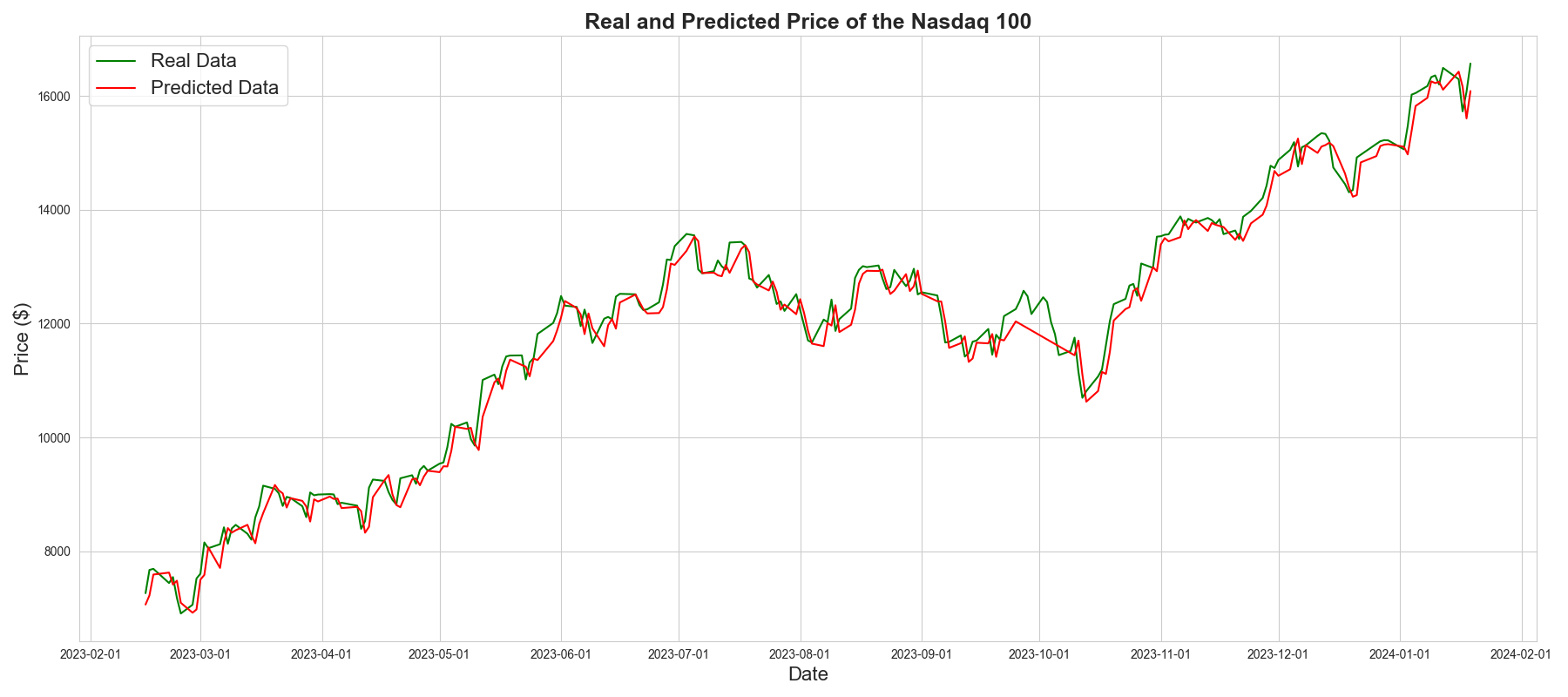

This project explores US Stock market data from 2019-2024, focusing on in-depth analysis of tech stock performance, market trends, and future predictions. Using advanced data science techniques and machine learning models, I conducted holistic price development analyses of multiple tech stocks, individual comparisons between trade volume and stock prices, and volatility analyses of financial markets including selected cryptocurrencies.

The financial markets generate vast amounts of data every day, and making sense of these patterns requires both technical expertise and analytical insight. This project aimed to leverage data science and machine learning techniques to extract meaningful patterns from US stock market data, with a particular focus on technology stocks during the volatile 2019-2024 period.

By analyzing historical price movements, trading volumes, and market volatility across different sectors, I developed models that could identify correlations between different market behaviors and potentially predict future movements. This project demonstrates the power of data-driven approaches in understanding financial markets and making informed investment decisions.

The analysis was conducted using Python with libraries including Pandas for data manipulation, Seaborn and Matplotlib for visualization, and PyTorch for building predictive models. The methodology included:

Visualizations played a crucial role in understanding market dynamics and communicating findings. The project produced several insightful visualizations that reveal patterns in stock market behavior.

.png)

The analysis revealed several key insights into market behavior during the 2019-2024 period:

The Nvidia stock has yielded high returns without major risks in the analyzed time period. An increased trade volume shows the public's interest in the company.

Even though a general upwards trend in stock prices is noticeable, investing at the wrong time could lead to significant losses. Further underlining the importance of long term investments.

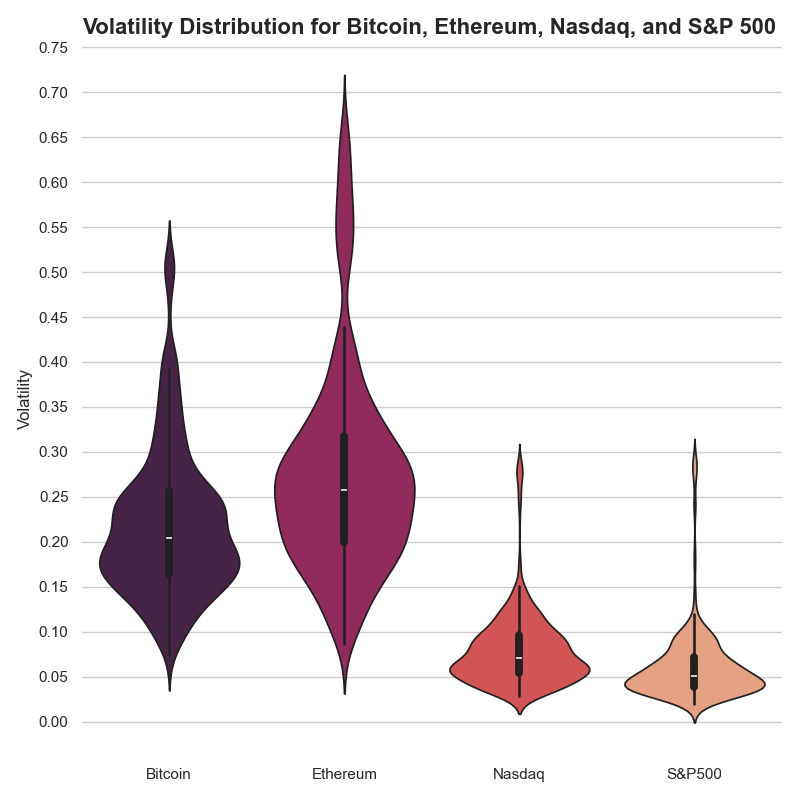

Compared to traditional financial markets, cryptocurrencies have a considerably higher volatility making them higher risk investments.

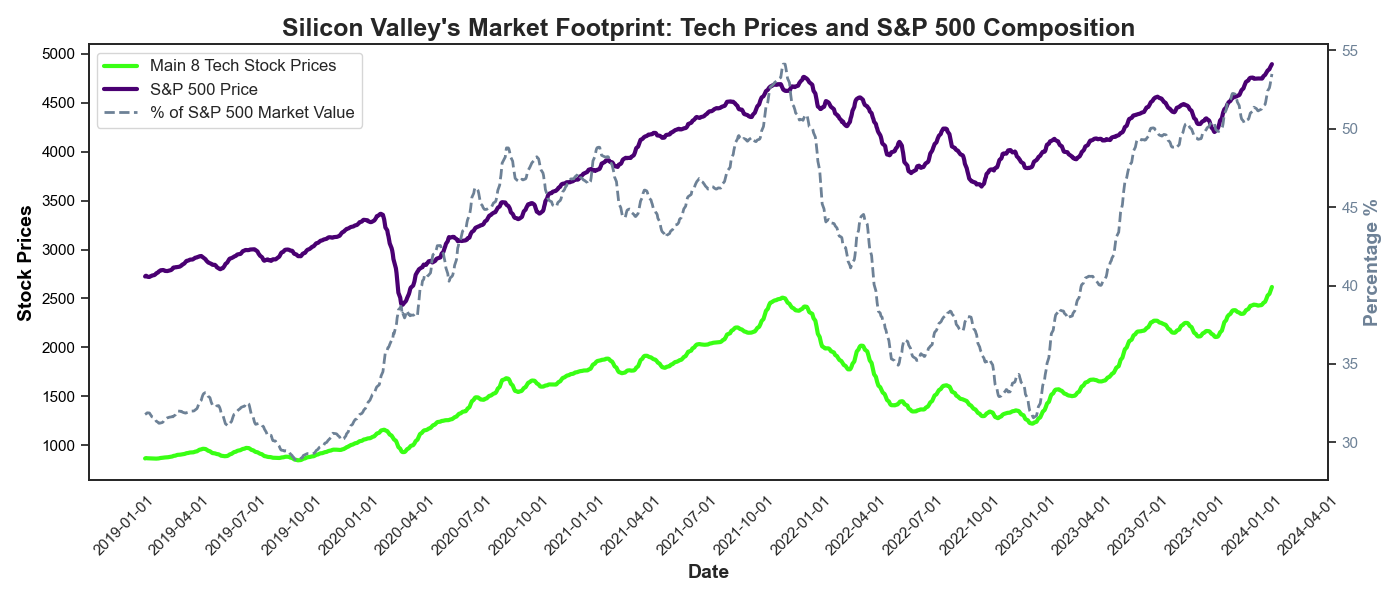

The S&P 500 has become more dependent on the performance of the top 8 tech stocks. The top 8 tech stocks make up 55% of the price, while only representing 1.6% of companies in the S&P500.

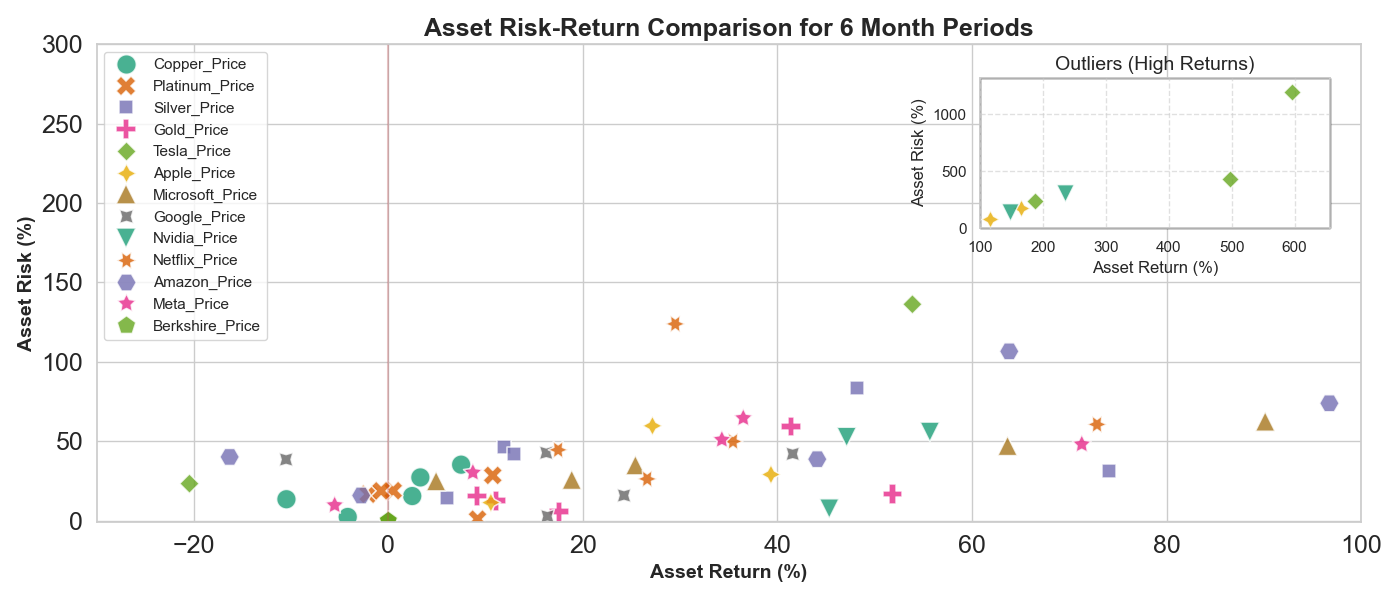

Investing in physical assets can yield constant and risk-free returns. Gold and silver showed promising returns, while copper and platinum were bad investment options.

Apple has one of the least volatile stocks on the market, while also having valuable returns. Low price fluctuations as well as low trade volumes indicate potential long-term investments. A steady price growth without major dips are key factors when looking at long-term holding.

This project demonstrates the value of applying data science techniques to financial market analysis. By combining statistical methods with machine learning approaches, it was possible to extract meaningful patterns from complex market data and build predictive models with practical applications. The insights gained from this analysis could help investors make more informed decisions and understand market dynamics in greater depth. Future work could expand this analysis to include sentiment data from news and social media to further enhance predictive capabilities.